Retirement planning for the self employed

Finance & Accounting

13 week ago — 3 min read

Planning for retirement: A guide for self-employed individuals

Planning for retirement is essential, especially for self-employed individuals and entrepreneurs running their own businesses. Without a structured retirement plan, the financial security you need in your later years could be at risk.

*This is a hypothetical example.

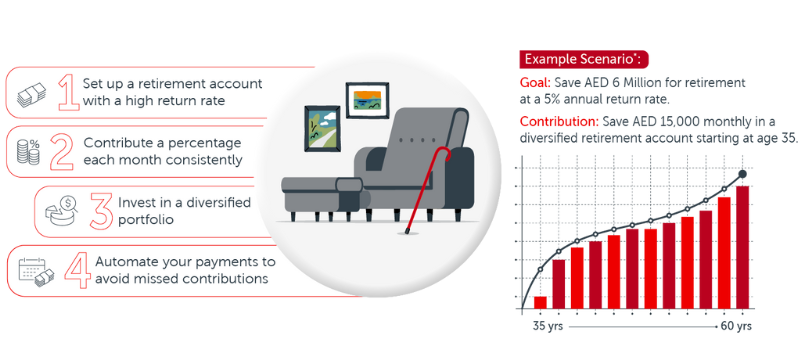

Here is a straightforward guide to help you set up a solid retirement plan.

Set up a retirement account

Start by opening a retirement account that offers a high return rate. This type of account allows your savings to grow over time due to the power of compound interest. Look for options that provide the best interest rates and minimal fees.

Contribute consistently

Make it a habit to contribute a percentage of your income to your retirement account every month. Consistency is key to building a substantial retirement fund. Even small, regular contributions can accumulate significantly over the years.

Invest in a diversified portfolio

Do not put all your eggs in one basket. Spread your investments across a variety of assets, such as stocks, bonds, and real estate. A diversified portfolio can help reduce risk and improve potential returns. Consult with a financial advisor to tailor your investment strategy to your risk tolerance and retirement goals.

Automate your payments

Set up automatic transfers to your retirement account to ensure you never miss a contribution. Automation simplifies saving and helps you stay on track with your retirement goals without needing to remember manual deposits.

Additional tips

- Review and adjust regularly: Periodically review your retirement plan to ensure it aligns with your financial situation and goals. Adjust your contributions and investment strategy as needed.

- Maintain an emergency fund: Keep an emergency fund separate from your retirement savings to cover unexpected expenses. This ensures your retirement funds remain untouched.

- Stay informed: Keep up with market trends and economic conditions that might affect your investments. Staying informed helps you make better financial decisions.

Planning for retirement as a self-employed individual involves setting up a high-return retirement account, contributing consistently, diversifying your investments, and automating payments. By following these steps, you can build a secure financial future and enjoy a comfortable retirement. Start early, stay consistent, and make informed decisions to ensure your retirement plan is robust and effective.

For small businesses to flourish, it is essential to focus on strategic planning and result-oriented goals. By honing in on these key principles, entrepreneurs can seize business opportunities and thrive. Learn more

Posted by

GlobalLinker StaffWe are a team of experienced industry professionals committed to sharing our knowledge and skills with small & medium enterprises.

View GlobalLinker 's profile

Other articles written by GlobalLinker Staff

All you need to know about cash flow management

13 week ago

Managing your business through mobile

13 week ago

Most read this week

Comments

Share this content

Please login or Register to join the discussion