State of e-Marketing in Retail

Retail

495 week ago — 4 min read

The RAI-Octane report gives an accurate idea of the difference between offline and online retailers marketing initiatives.

Are retailers spoilt for choice or are the choices spoiling retailers' marketing strategy? The RAI-Octane report on the state of retail e-marketing indicates that the truth lies somewhere in between. Online retailers are focusing more than ever on customer loyalty and brand building. Retailers overall are using (or attempting to use) technology more efficiently. And yes, people are investing in the mobile platform.

But the impact of email and e-marketing is still less than 10% of revenue in most cases, either as a cause of or consequence of budget allocations to online marketing decreasing during 2013-14.

Finally, the online retailer is using traditional marketing (print, TV) to increase volumes, and ironically, is investing less than 10% in e-marketing. Online retail in India has also not implemented 'cart abandonment' programs – a reflection of the nascency of the market.

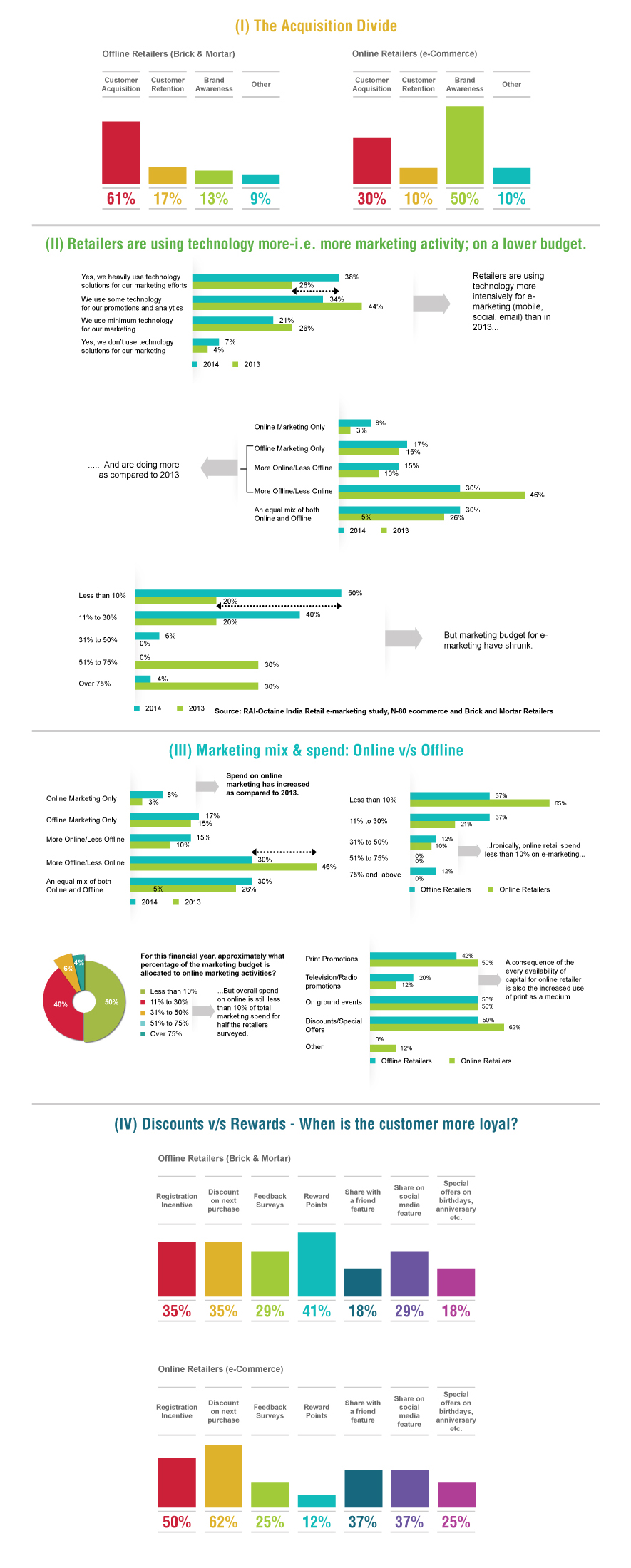

The acquisition divide

Primary goals of online retailers are different from their offline counterparts. Online retailers initially acquired customers by competing on price. Now marketing focus has shifted to brand awareness – 50% online retailers ranked this as their main marketing priority. In contrast, 61% offline retailers ranked customer acquisition as their main priority. The 'acquisition' divide is likely due to the need for online retailers to retain customers (there is more to shopping than price, after all) and a similar pressure on their offline counterparts to show higher same-store growth.

Doing more with less

Retailers are using more technology, and increased e-marketing (social, mobile, email) activities, but budget allocations for e-marketing have decreased. 50% of retailers surveyed allocate less than 10% of marketing budget to e-marketing; up from 20% last year.

Marketing mix and spend: Online v/s Offline marketing

As compared to 2013, the marketing mix has shifted towards online. In 2013, 46% of retailers used more offline than online. This has decreased in 2014 to 30%.

But, on an overall basis, online budgets are still 10% or less in terms of overall spend. Consequently, revenue from e-marketing is also low – less than 10% in 75% of retailers.

The irony is that it's the offline retailers who spend less than 10% of total marketing spend on e-marketing. They spend more on print than online retailers – a consequence of larger marketing budgets and the relatively easy availability of capital.

Mobile @ e-marketing

There has been a perceptible shift in terms of focus and investment on mobile technologies. In 2013, 20% of retailers surveyed were investing in mobile – in 2014, this figure nearly doubled to 37%. Most of the large retailers have launched mobile apps with full payment integration and online retailers have also supported the launch of the mobile app with hi-voice print and TV campaigns.

Customer engagement: Reward v/s Loyalty

The two segments of retailers differ in their approach to rewarding customers for engagement. The offline retailers focus on loyalty programs (reward points – 41%) while the online retailers use discounts on the next purchase (62%).

Excerpted from RAI-Octane report India Retail E-Marketing Study 2014. You can download a copy of the entire report from http://goo.gl/Ymz08d

Article Source: STOrai Magazine

Network with SMEs mentioned in this article

View STOrai 's profile

SME Inspirations

Most read this week

Comments (1)

Please login or Register to join the discussion